The ability for a business to reach a greater number of customers by accepting credit/debit cards is one way for a business to get more revenue. Even in brick-and-mortar retail, customers don’t always have cash on them and for online transactions it’s crucial. So, for a business to accept electronic payments, a merchant account is required. In this article, we’ll talk about some steps you should take when selecting and setting up a merchant account.

What is a merchant account?

A merchant account is a bank account that enables the holder to accept debit cards, credit cards, Google Pay, Apple Pay, electronic wallets, and more. To create a merchant account, a business owner must already have a business bank account. The agreement between the business owner, which is the merchant, and a bank allows the bank institution to process electronic payments on behalf of the merchant.

How does a merchant account work?

You may be wondering, what goes on behind the scenes in a merchant account when a transaction occurs? When an electronic payment is a processed, the personal payment data of a customer is encoded and communicated to the bank. The acquiring bank sends it to a matching card association like American Express, Visa, etc, and the card association connects back with the bank. Then an issuing bank checks the identity and fund availability to authorize the money to move it from a customer’s bank account.

Assess your needs

Aside from deciding which credit cards you’ll want to process; you’ll also need to decide how you want to accept them. From in-person solutions, to mobile and online payments, you’ll need to evaluate how customers pay you and select a merchant service provider that will give you the flexibility you need with taking electronic payments. If you’re planning on expanding in the future, also want to consider the future of the business and what future needs will arise.

Compare merchant account providers

After evaluating what your business needs are, you can then use that information to start assessing merchant account providers. Here are some key things you’ll want to look for in a provider:

Security and PCI Compliance

PCI (Payment Card Industry) compliance means that business is following proper security measures to effectively accept, process, and store credit card payments. By choosing a PCI compliant merchant account provider with strong security features, you can feel safer knowing credit card information is protected and gain more peace of mind.

Next-day funding

Image you made a sale and processed a credit card but didn’t see the money in your business bank account until a week later. Waiting for funds can be frustrating and boggle down the cash flow of the business, making it harder to pay bills on time. This is why next-day funding is such a popular and demanded feature.

24/7 In-House Customer Support

If the credit card processor stops working or malfunctions it puts profits at stake or could result in a loss of profit. Therefore, choosing a merchant service provider that has 24/7 in-house customer support where you can talk to a live representative to quickly solve any issues is one of the most important features when selecting a provider.

Pricing Transparency

Credit card pricing models and fees can be confusing, therefore it’s important that you consider a provider that is fully transparent and offers a plan that best suits your business.

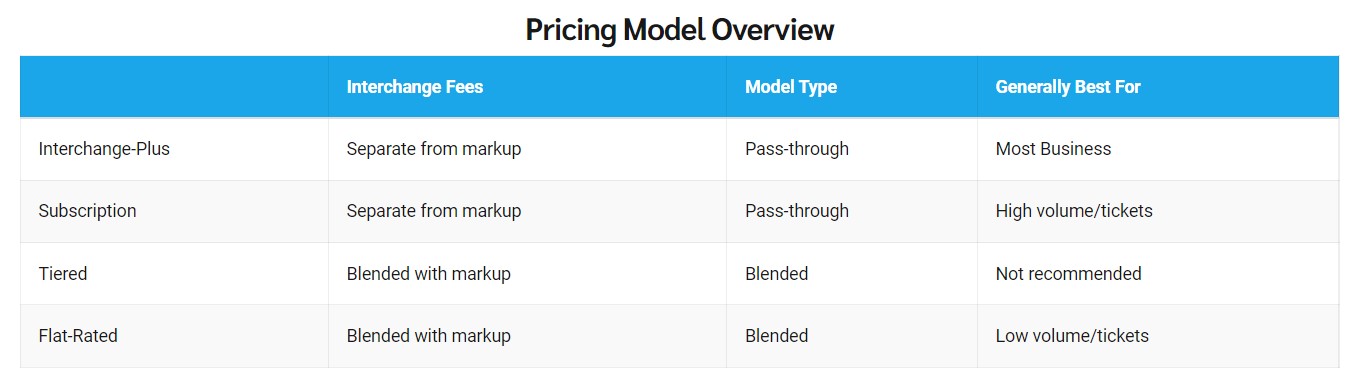

The four most common pricing models are divided into two categories, pass-through or blended. Pass-through pricing models keep interchange fees, the fees set by the card associations, and markup fees, the fees set by your merchant service provider, separate.

Since the fees in pass-through pricing models are separate it allows the business owner to see what the merchant services provider’s markup rate is.

In a Blended pricing model, the rates are hidden in the interchange fees. Although blended pricing models are less transparent, they could work for businesses that are processing a low volume of transactions. The table below was created by Merchant Maverick for a comparison of the pricing models and which types of businesses they work best for.

POS System on the Market Today

Unnecessary fees

It’s a good idea to investigate any fees that will be included in your merchant account service. Many providers will charge fees that are totally unnecessary and only hurt the merchant. Therefore, you should ask for a thorough list of all the fees and check for customer service fees, annual fees, batch fees and monthly minimum fees.

Submit an application

After you’ve had a chance to compare merchant account providers and selected one, you’ll need to fill out an application using the right documentation. Detailed information about the business will be required, so it’s important to be prepared. You’ll most likely be asked to provide:

-

Contact information

-

Start date for the business

-

Authorized signer information

-

Bank account and routing numbers

-

Tax Identification

-

Estimated processing volume in dollars

Submit to underwriting

For the account provider and acquiring bank, starting a merchant account, especially for a new business, is a risk they take on. Therefore, the provider will assess your business and underwrite or in other words accept liability, thus guaranteeing payment in case loss or damage occurs.

During this underwriting process they’ll look for red flags like high-risk businesses or industries, warning signs of fraud, or businesses that have only been operating for a very short period.

Established businesses that have proven good standing for at least a few months to a year should make it through the underwriting process without any issues. However, banks are less likely to accept the risk of a new business, so new startups may not be able to make it through the underwriting stage.

Open a merchant account and grow your business

Digital payments and new forms of electronic payments have been on the rise for several decades now and if you want to be able to bring in sales through as many channels as possible, now and in the future, then you’ll want to be prepared with the right merchant service provider.

Most customers prefer to use credit cards over cash so it’s important to accommodate customers and capitalize on every selling opportunity. With these steps, businesses can open a merchant account and experience all the benefits of accepting credit card payments.

Providers like Rebel Payments are revolutionizing merchant services by offering innovative solutions to help your business save money and grow. With Rebel, plans are customized for each member’s business and payments are channeled back into areas designed to help grow your business.

Rebel Payments is a direct tier 1 processor for thousands of companies with best-in-class POS systems, customized processing plans, marketing services, and excellent customer support to help businesses of all types and sizes grow, save money, and run more efficiently. Give us a call today to join the rebelution and start growing your business.